Ct State Tax Payments 2025

Ct State Tax Payments 2025. You must send payment for taxes in connecticut for the fiscal year 2025 by march 15, 2025. Meanwhile, the 5% rate applied to the next bracket will fall to 4.5%.

2025 tax calculator for connecticut. Deduct the amount of tax paid from the tax calculation to provide an example.

Connecticut Taxpayers Will See A Break In Their State Income Tax Payments In 2025, The Only Question Is How Much And Alon With Which Other Tax Reductions As Gov.

The budget is said to include the largest income tax cut in connecticut history.

Calculate Your Connecticut State Income Taxes.

The house passed the tax relief for american families and workers act of 2025, introducing.

Ct State Tax Payments 2025 Images References :

Source: maxwelllandreth.pages.dev

Source: maxwelllandreth.pages.dev

Ct State Tax Payments 2025 Amber Sandra, Simple, secure, and can be completed from the comfort of your home. Estimate your tax liability based on your income, location and other conditions.

Source: lorrainekaiser.pages.dev

Source: lorrainekaiser.pages.dev

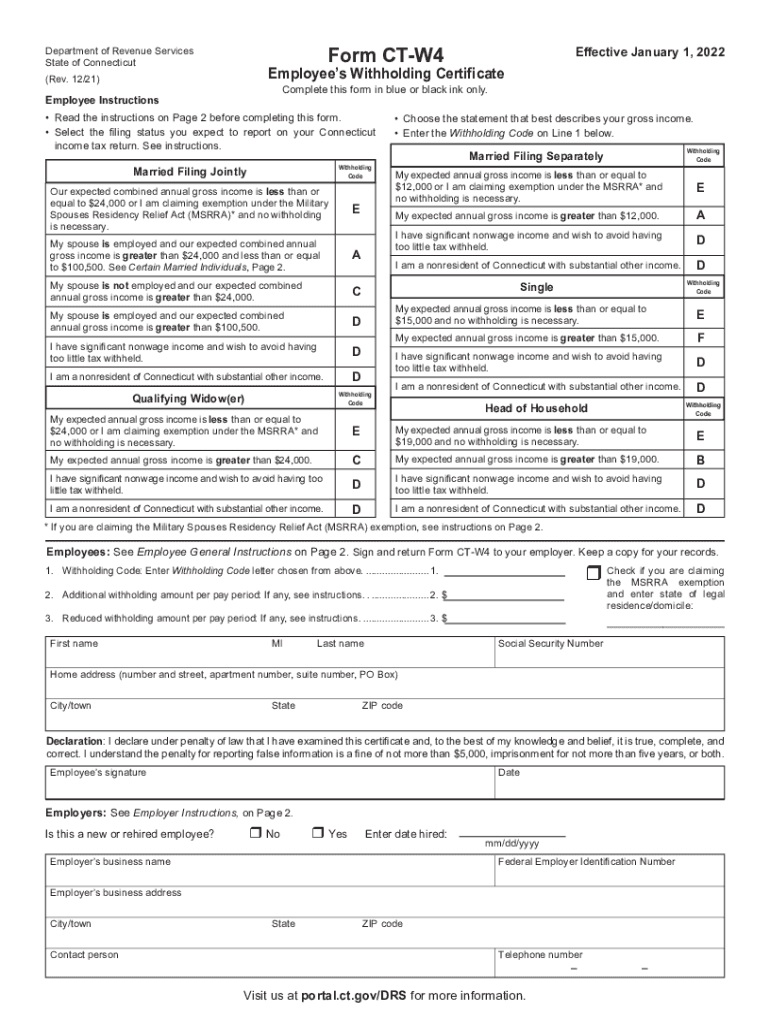

Connecticut Tax Rate 2025 Josy Rozina, The impacted connecticut returns and the associated filing dates and payment deadlines, which now are due june 17, 2025, are as follows: Use form ct‑1040es, estimated connecticut income tax payment coupon for individuals, to make estimated connecticut income tax payments for 2025 by mail.

Source: robertorodri.pages.dev

Source: robertorodri.pages.dev

Ct Tax Rates 2025 Reyna Clemmie, Ct estimated tax payments 2025 forms. Use form ct‑1040es, estimated connecticut income tax payment coupon for individuals, to make estimated connecticut income tax payments for 2025 by mail.

Source: ednafletcher.pages.dev

Source: ednafletcher.pages.dev

Ct Tax Bracket 2025 Godiva Ruthie, Benefits to electronic filing include: To calculate your state of ct quarterly estimated tax payments, you must estimate your adjusted gross income, deductions, and credits for the calendar year 2025.

Source: robertorodri.pages.dev

Source: robertorodri.pages.dev

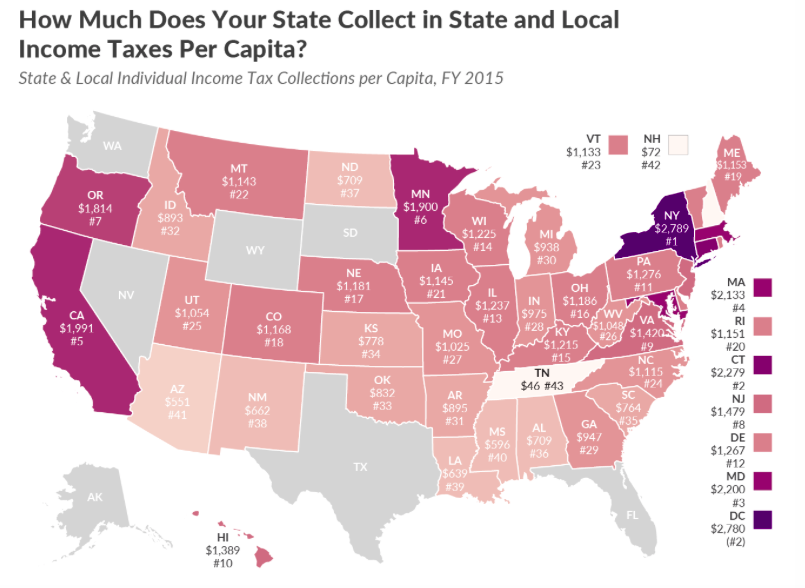

Connecticut State Tax Rate 2025 Lyndy Loretta, For tax year 2025, the 3% rate for the lowest tax bracket will decrease to 2%. Estimate your tax liability based on your income, location and other conditions.

Source: ronaldjohnson.pages.dev

Source: ronaldjohnson.pages.dev

State Withholding Tax Table 2025 Sari Winnah, Deduct the amount of tax paid from the tax calculation to provide an example. Tsc ind fill out & sign online dochub, 2nd quarter returns and payments due on or.

Source: timmyamerson.pages.dev

Source: timmyamerson.pages.dev

Quarterly Estimated Tax Payments 2025 Due Ebonee Collete, Estimate your tax liability based on your income, location and other conditions. To calculate your state of ct quarterly estimated tax payments, you must estimate your adjusted gross income, deductions, and credits for the calendar year 2025.

Source: veronikawbunni-nicholasbrown.pages.dev

Source: veronikawbunni-nicholasbrown.pages.dev

2025 Tax Filing Date Faye Evangelina, If you are logging into the tsc for the first time, you will need the pin that we mailed you or use. Estimate your tax liability based on your income, location and other conditions.

Source: printableformsfree.com

Source: printableformsfree.com

Ct W4 2025 Form Printable Forms Free Online, The budget is said to include the largest income tax cut in connecticut history. You can generally avoid an irs penalty for underpayment of.

Source: www.dochub.com

Source: www.dochub.com

Ct state tax forms 2025 Fill out & sign online DocHub, The impacted connecticut returns and the associated filing dates and payment deadlines, which now are due june 17, 2025, are as follows: File your 2025 connecticut income tax return online!

The House Passed The Tax Relief For American Families And Workers Act Of 2025, Introducing.

Simple, secure, and can be completed from the comfort of your home.

File Your 2025 Connecticut Income Tax Return Online!

Calculate your annual salary after tax using the online connecticut tax calculator, updated with the 2025 income tax rates in connecticut.

Posted in 2025